Tech News

Intel holds firm against takeover bids, rejects Arm’s acquisition proposal

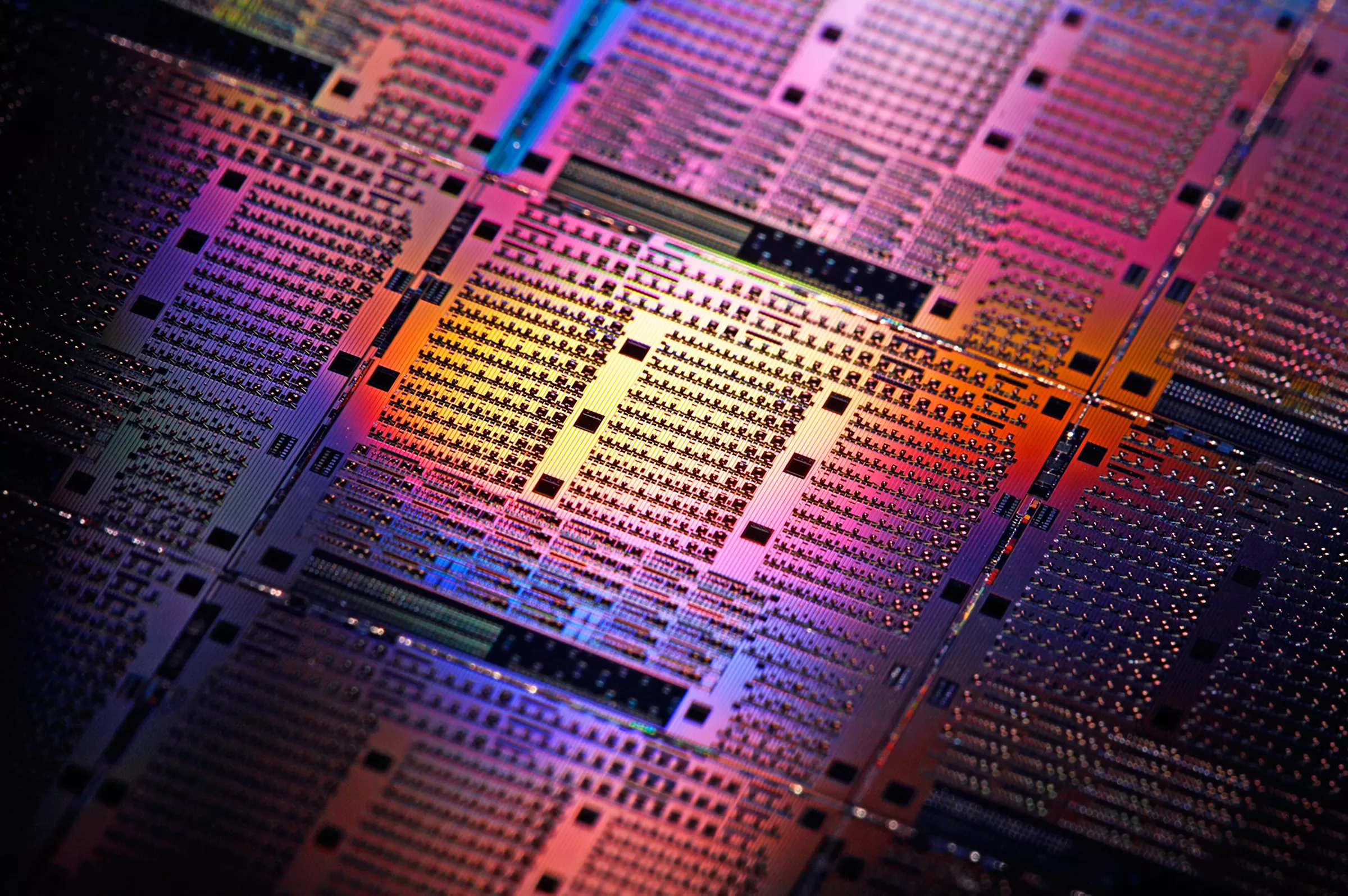

In context: As Intel faces challenges, various companies are eyeing opportunities to either acquire the company as a whole or purchase specific parts of it. Despite Intel’s commitment to its turnaround plan, some potential deals highlight the extent of Intel’s decline. One such example is Arm’s offer to acquire Intel’s key division, which Intel ultimately rejected.

Reports indicate that Arm approached Intel with a proposal to acquire its product division, responsible for developing chips for PCs, servers, and networking equipment. However, Intel declined the offer, emphasizing that the division is not up for sale. Arm was not interested in acquiring Intel’s foundry assets.

Intel’s rapid decline over the past year has sparked takeover rumors, with Qualcomm reportedly making a recent offer. Intel is rumored to be considering selling off certain parts of its business to improve its financial position. One potential candidate for sale is its Altera programmable chip division, acquired for $16.7 billion in 2015, although CEO Pat Gelsinger has denied these rumors.

According to Sandra Rivera, Intel is adhering to its strategy of divesting a portion of its stake in Altera, with plans to complete the spin-off through an initial public offering by 2026 at the latest. In the previous year, Intel spun off Altera as an independent entity in preparation for a future IPO.

Arm’s potential acquisition of Intel’s product units could have supported its goal of expanding into PCs and servers, where Intel currently holds a dominant position. This move would have allowed Arm to offer fully developed products, a strategy that Intel could have facilitated.

However, Intel deemed the deal unsuitable as it is already implementing strategies to revitalize its business, making it less inclined to sell a core business segment. Furthermore, Intel has other options, such as a potential equity-like investment from Apollo and significant funding through the Chips Act from the government.

An Arm takeover of Intel’s product division would have faced significant challenges, including regulatory scrutiny, financial considerations, and technical hurdles related to merging different architectures. Additionally, Arm’s existing clients may have opposed the deal, fearing increased competition.

-

Breaking News2 years ago

Breaking News2 years agoCroatia to reintroduce compulsory military draft as regional tensions soar

-

Destination1 year ago

Destination1 year agoSingapore Airlines CEO set to join board of Air India, BA News, BA

-

Gadgets1 year ago

Gadgets1 year agoSupernatural Season 16 Revival News, Cast, Plot and Release Date

-

Productivity2 years ago

Productivity2 years agoHow Your Contact Center Can Become A Customer Engagement Center

-

Tech News2 years ago

Tech News2 years agoBangladeshi police agents accused of selling citizens’ personal information on Telegram

-

Gadgets10 months ago

Gadgets10 months agoGoogle Pixel 9 Pro vs Samsung Galaxy S25 Ultra: Camera Comparison Review

-

Gaming2 years ago

Gaming2 years agoThe Criterion Collection announces November 2024 releases, Seven Samurai 4K and more

-

Gadgets10 months ago

Gadgets10 months agoFallout Season 2 Potential Release Date, Cast, Plot and News