Tech News

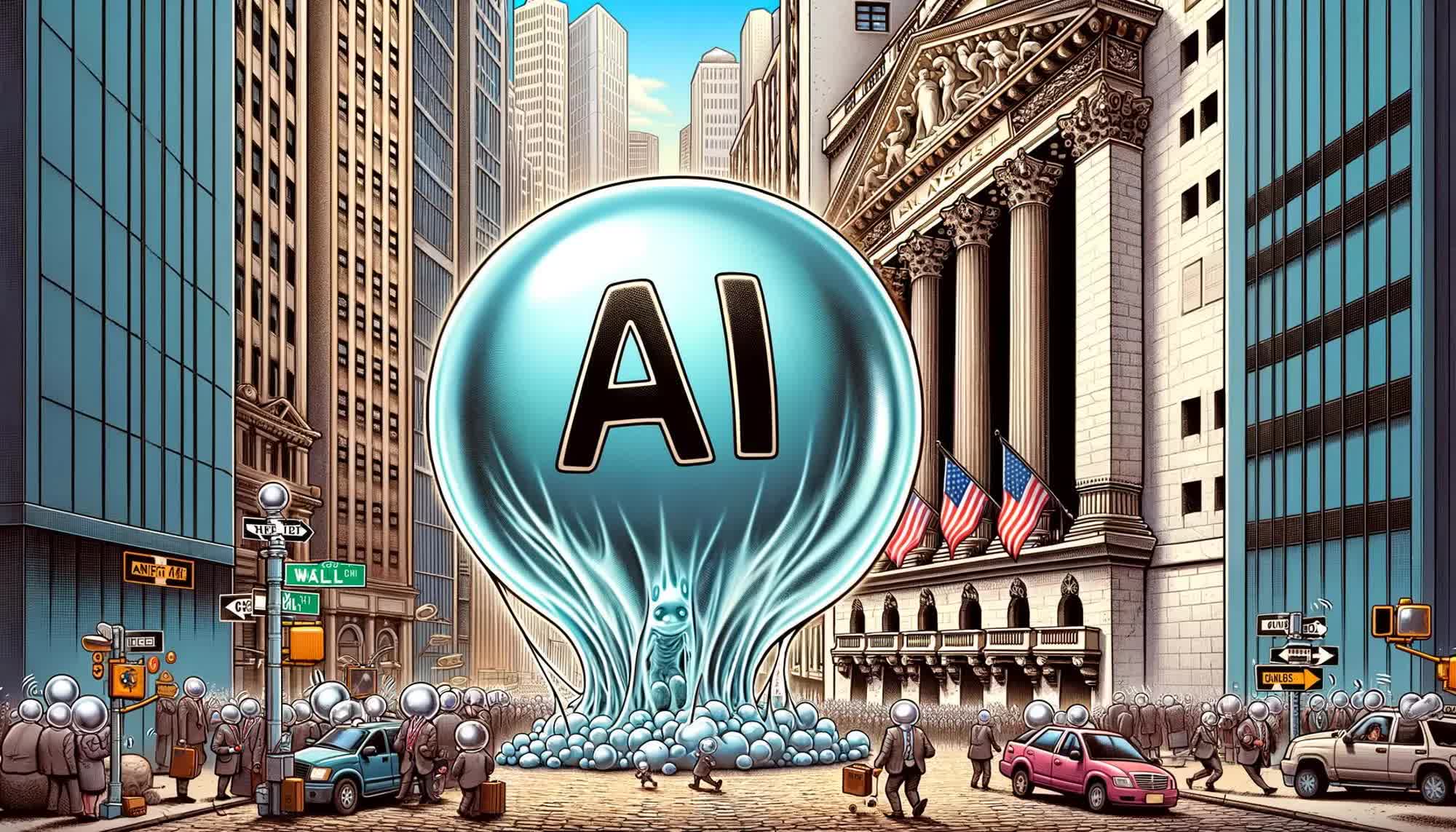

Big Tech doubles down on AI, $200 billion gamble raises concerns on Wall Street

Why It Matters

Cutting corners: Tech executives say there are long-term benefits to their AI investments, drawing parallels to the early days of cloud technology. However, Silicon Valley’s spend-first, profit-later attitude tests many investors’ patience. Amazon, Microsoft, Meta, and Alphabet have invested significant sums in AI infrastructure – money that has not yielded justifiable returns at this point – to the displeasure of Wall Street. And yet Big Tech is not to be deterred.

Tech giants are set to spend a staggering $200 billion on AI-related capital expenditures this year, according to Bloomberg’s calculations, marking an all-time high for these companies. It is an unprecedented level of investment, ranging from securing scarce high-end chips and constructing expansive data centers to forging deals with energy providers and even reviving a controversial nuclear plant for power.

Amazon is leading the charge with a projected record $75 billion in spending for 2024, as CEO Andy Jassy describes AI as a “once-in-a-lifetime opportunity.” Analysts at MoffettNathanson called the sum “truly staggering.”

Meta is not far behind, with capital spending potentially reaching up to $40 billion in 2024, while CEO Mark Zuckerberg commits to increased investment in AI language models and futuristic projects.

Alphabet has reported higher-than-expected capital expenditures and is projecting “substantial” increases in spending for 2025.

Microsoft’s AI-related expenses are also soaring, having spent $14.9 billion in a single quarter, a 50 percent increase from the previous year. Meanwhile, it faces challenges in meeting demand due to data center capacity constraints.

Apple, while not as aggressive in its AI spending, has introduced “Apple Intelligence,” a suite of AI-enhanced services, though these new AI products have not significantly impacted its financial results.

Wall Street’s response was mixed as the tech giants reported varied financial results this quarter. Amazon and Alphabet saw their shares soar after beating earnings expectations, largely due to strong growth in their cloud-computing divisions. However, Meta and Microsoft experienced stock declines following concerns about spending plans and cloud revenue growth projections.

While some analysts remain optimistic about the long-term potential of these AI investments, concerns persist regarding the massive expenditures. JPMorgan analysts, for example, noted that Microsoft’s data center supply issues might “modestly” restrict its cloud business but viewed the company’s investments, particularly in OpenAI, as “planting the longer-term seeds for success.”

These companies are also rolling out products to justify, at least in part, the massive costs of their AI investments. Microsoft is pursuing various monetization pathways for AI, including through Azure cloud services and GitHub Copilot. Meta has said that AI is already positively impacting its core advertising business by allowing firms to create more engaging ads using AI tools, while Amazon’s AWS and Google Cloud have reported significant revenue growth, partially attributed to AI services.

-

Breaking News2 years ago

Breaking News2 years agoCroatia to reintroduce compulsory military draft as regional tensions soar

-

Destination1 year ago

Destination1 year agoSingapore Airlines CEO set to join board of Air India, BA News, BA

-

Gadgets1 year ago

Gadgets1 year agoSupernatural Season 16 Revival News, Cast, Plot and Release Date

-

Productivity2 years ago

Productivity2 years agoHow Your Contact Center Can Become A Customer Engagement Center

-

Tech News2 years ago

Tech News2 years agoBangladeshi police agents accused of selling citizens’ personal information on Telegram

-

Gadgets10 months ago

Gadgets10 months agoGoogle Pixel 9 Pro vs Samsung Galaxy S25 Ultra: Camera Comparison Review

-

Gaming2 years ago

Gaming2 years agoThe Criterion Collection announces November 2024 releases, Seven Samurai 4K and more

-

Gadgets10 months ago

Gadgets10 months agoFallout Season 2 Potential Release Date, Cast, Plot and News