Breaking News

Why the ‘war on inflation’ is over — even though the ‘experts’ don’t get it

The War on Inflation: A Closer Look

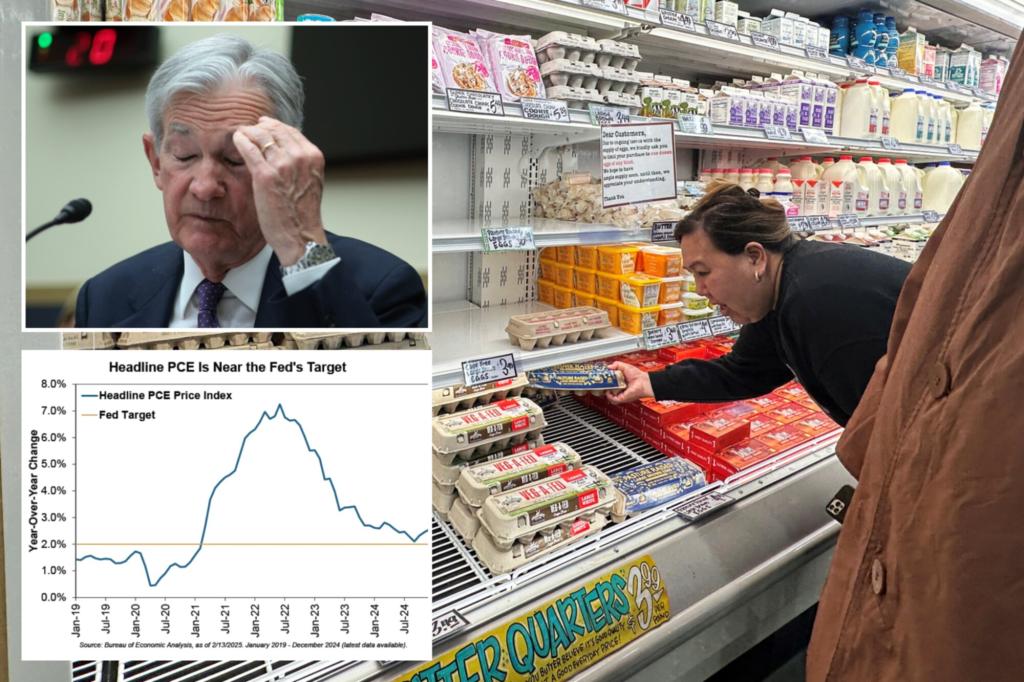

As the war on inflation continues, shoppers are feeling the impact in their grocery bills, with recent concerns over rising egg prices. Economists, politicians, and experts are closely monitoring the Consumer Price Index (CPI) for signs of inflationary pressure, especially after a notable increase in January. However, it’s important to consider the bigger picture when evaluating the current state of inflation and its implications for investors.

It’s essential to understand that inflation and prices are not the same. While inflation refers to the rate at which prices are rising, actual prices do not always fall. The goal of winning the inflation war is not to lower prices but to slow down their rate of increase.

Despite the challenges faced by households due to inflation since 2021, it’s crucial to recognize the efforts to combat inflation and stabilize the economy. The Federal Reserve plays a key role in managing inflation by controlling the money supply and ensuring sustainable economic growth.

One common misconception is that wage growth leads to inflation. However, as detailed in previous analyses, wage growth is not inherently inflationary and should be viewed in the context of broader economic trends.

While tariffs can impact prices in certain sectors, they are not the primary driver of inflation. The focus should be on understanding the complex dynamics of supply and demand in the global economy.

As investors navigate the ever-changing financial landscape, it’s important to focus on long-term strategies and avoid getting caught up in short-term fluctuations. By staying informed and adapting to market conditions, investors can position themselves for success in a post-inflation era.

The bottom line is that the war on inflation is nearing its end, and a bullish outlook may be warranted for the future. It’s essential to stay vigilant, stay informed, and be prepared for whatever comes next in the ever-evolving world of finance.

Ken Fisher is the founder and executive chairman of Fisher Investments, a bestselling author, and a respected voice in the global financial community.

-

Breaking News2 years ago

Breaking News2 years agoCroatia to reintroduce compulsory military draft as regional tensions soar

-

Destination1 year ago

Destination1 year agoSingapore Airlines CEO set to join board of Air India, BA News, BA

-

Gadgets1 year ago

Gadgets1 year agoSupernatural Season 16 Revival News, Cast, Plot and Release Date

-

Productivity2 years ago

Productivity2 years agoHow Your Contact Center Can Become A Customer Engagement Center

-

Tech News2 years ago

Tech News2 years agoBangladeshi police agents accused of selling citizens’ personal information on Telegram

-

Gadgets10 months ago

Gadgets10 months agoGoogle Pixel 9 Pro vs Samsung Galaxy S25 Ultra: Camera Comparison Review

-

Gaming2 years ago

Gaming2 years agoThe Criterion Collection announces November 2024 releases, Seven Samurai 4K and more

-

Gadgets10 months ago

Gadgets10 months agoFallout Season 2 Potential Release Date, Cast, Plot and News